e filing 2019 deadline

E-filers are reminded that using the FIRE System requires following the specifications contained in Pub. E-file fees do not apply to New York state returns.

Did You Miss The 2019 Tax Deadline Priortax Blog

File 2018 Tax Return.

. A disputed association between 1 April and foolishness is in Geoffrey Chaucers The Canterbury Tales 1392. Youll be able to create Forms W-2 online and submit them to the SSA by typing your wage. Starlink is a satellite internet constellation operated by SpaceX providing satellite Internet access coverage to 40 countries.

The e-filing deadline is October 17 2022 but you will need to file your return before the end of September to qualify. Additional fees apply for e-filing state returns. File 2017 Tax Return.

First your deadline is extended for 180 days after the later of. Filing the 990 forms electronically helps the IRS process returns more quickly. E-Filing in civil cases when filing a Praecipe Order of Sale filer must also submit document type Online Auction Fee and pay a 220 fee effective March 1st 2019.

IRS and state e-filing season and extension deadline - from the IRS opening date to the October date the current tax year returns are able to be electronically filed. Imports from Quicken 2019 and higher and QuickBooks Desktop 2019 and higher. I have registered branches in multiple jurisdictions how do I submit a certification only on behalf of those that have a certification requirement.

Will there be an Extended Tax Deadline in 2022. 116-94 clarifies that employees described in section 414e3B which include ministers employees of a tax-exempt church-controlled organization including a nonqualified church-controlled organization and employees who are included in a church plan under certain circumstances after separation from the. E-file Your Extension Form for Free.

These are some reasons you may want to file an. Pursuant to ORC 2329153 Local Rule 9 and the Seventh Administrative Order re. Imports from Quicken 2019 and higher and QuickBooks Desktop 2019 and higher.

Frozen 100 percent fruit juice concentrate as well as some sugars found. In the Nuns Priests Tale a vain cock Chauntecleer is tricked by a fox on Since March began thirty days and two ie. April 15 2023 and for 2020 tax return refunds it is April 15 2024.

System maintenance occurs nightly beginning at midnight and may last up to one hour. Prior year 2019 earned income. Form 8809-I Application for Extension of Time to File.

The deadline for filing your return paying any tax due filing a claim for refund and taking other actions with the IRS is extended in two steps. Filing this form gives you until October 15 to file a return. No subscription fees or contracts Live support by phone email or chat.

An extension of time to file your return does not mean an extension of time to pay your taxes. Individual tax filers regardless of income can use Free File to electronically request an automatic tax-filing extension. However filing a belated ITR.

What are the filing deadlines for 1099-MISC and 1099-NEC. Our experienced journalists want to glorify God in what we do. American Family News formerly One News Now offers news on current events from an evangelical Christian perspective.

Details about Late Filing Tax Penalties Relief for 2019 2020 Tax Returns. If you e-file your taxes you must do so by April 18 as well. SpaceX started launching Starlink satellites in 2019.

E-file fees do not apply to New York state returns. The last date for filing income tax return ITR for FY 2021-22 AY 2022-23 is July 31 2022. Meet your IRS Mandated E-filing Deadline with ExpressTaxExempt.

The deadline to file a 2021 tax return has passed. If October 15 falls on a Saturday Sunday or legal holiday the due date is delayed until the next business day. The Ministry of Foreign Affairs formulates implements and presents the foreign policy of the Government of IsraelIt represents the state vis-a-vis foreign governments and international organizations explains its positions and problems endeavors to promote its economic cultural and scientific relations and fosters cooperation with developing countriesIn addition the.

File 2014 Tax Return. The filing deadline for the FATCA Report Form 8966 will be extended from March 31 2020 to July 15 2020. Quicken and QuickBooks import not available with TurboTax installed on a Mac.

Division O section 111 of PL. By filing Form 4868 you can add 6 months to your filing deadline. 32 days since March began which is 1 April.

If this deadline is missed by the individual taxpayers then they have an option to file a belated income tax return. Beginning with the 2020 tax year the Form 1099-MISC deadline is March 1 if you file on paper and March 31 if you file electronically. Additional fees apply for e-filing state returns.

Quicken and QuickBooks import not available with TurboTax installed on a Mac. Latest breaking news from New York City. As of September 2022 Starlink consists of over 3000 mass-produced small satellites in low Earth orbit LEO which communicate with designated ground.

The deadline to file a 2021 tax return has passed. Wondering whether or not you will face federal penalties for not filing your tax return by Tax Day. In November 2019 the United States Patent and Trademark Office published a second edition of the America Invents Act AIA Trial Practice Guide Practice.

The Taxpayer First Act of 2019 enacted July 1 2019 authorized the Department of the Treasury and the IRS to issue regulations that reduce the 250-return requirement for 2022 tax returns. Deadline for submission of comments on patent eligibility jurisprudence extended to October 15. View My Prior Year Returns.

Penalty for Filing a Tax Return Late. If you expect to owe money youre should estimate the amount due and pay it with your Form 4868. It also aims for global mobile phone service after 2023.

With COVID challenges the tax deadline has been extended in recent years to provide more time for taxpayers and the government to get things together. The definition excludes fruit or vegetable juice concentrated from 100 percent fruit juice that is sold to consumers eg. Instead of ordering paper Forms W-2 and W-3 consider filing them electronically using the SSAs free e-file service.

States followed suit in recent years. May 5 2020. Although the origins of April Fools is unknown there are many therories surrounding it.

Beginning with tax year 2020 Form 1099-NEC must be filed by January 31 of the following year whether you file on paper or electronically. The same rule applies for e-filing your taxes. Online filing of plant patent applications allowed until further notice.

File 2016 Tax Return. The deadline to claim 2019 tax return refunds is. Major blackout hits New York City on July 13 1977 On July 13 1977 45 years ago Wednesday a major blackout hit New York City.

If you filed an extension by April 18 2023 2022 tax year filing deadline it extends your filing deadline to October 16 2023. Visit the SSAs Employer W-2 Filing Instructions Information webpage at SSAgovemployer to register for Business Services Online. File 2019 Tax Return.

File 2015 Tax Return. If you owe taxes you still need to pay them by April 18 2022.

Tax Extension Form 4868 Efile It Free By April 18 2022 Now

![]()

File 2019 Federal Taxes 100 Free On Freetaxusa

Michigan Extends State Tax Filing Deadline Due To Coronavirus Crisis

2019 1099 W 2 And Aca Filing Deadlines To Irs And Ssa Tax Software Web Support Services

January 31 Update Idor Delays E Filing Deadline For W 2s And 1099s Center For Agricultural Law And Taxation

Freetaxusa Free Tax Filing Online Return Preparation E File Income Taxes

Taxes Are Due Oct 15 If You Received An Extension The New York Times

Deadline To File Taxes With The Irs Is April 15 Last Minute Tips Mailing Info And More Pennlive Com

Tax Extension Deadline What To Know And When To File Money

Late Filing Or Late Payment Penalties Missed Deadline 2022

When Are Taxes Due 2022 Filing Extension Deadlines Bench Accounting

Free Individual Tax E Filing Islamic Center Of Boca Raton Faith Into Action

Integrity Data A Leader In Earning Aca E Filing Credentials Integrity Data

Kentucky Income Tax Filing Deadline Is July 15 Covid 19 Disruptions Caused Three Month Extension Nkytribune

File Bears Now For Fy 2019 E Rate Reimbursements E Rate In Pennsylvania

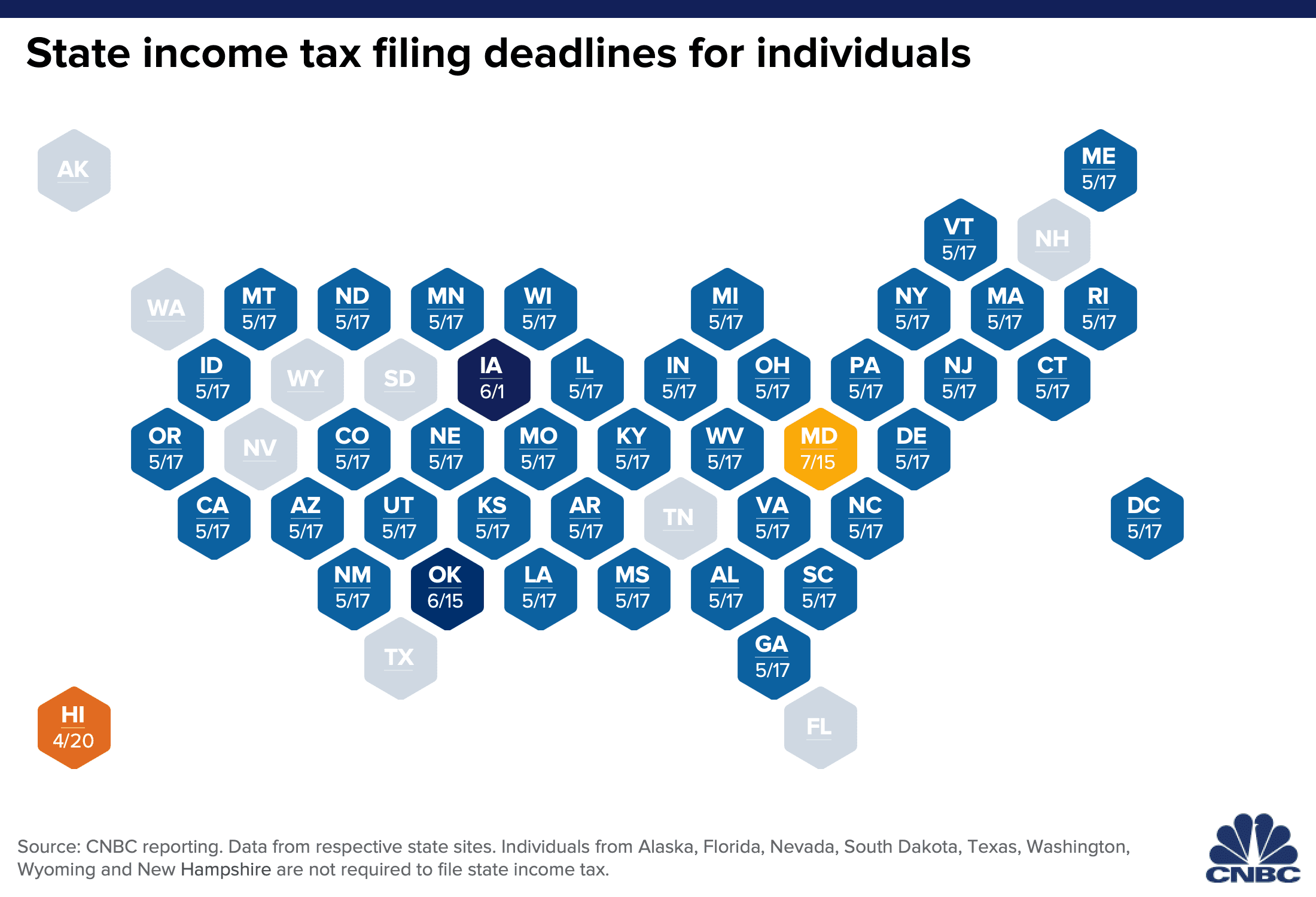

Irs Extended The Federal Tax Deadline When State Tax Returns Are Due

Tax Day 2019 No Time To File Here S What To Know About Getting An Extension Orange County Register

Comments

Post a Comment